Much like the rest of the global market, Australia and New Zealand have seen their share of ups and down over the past year. This is especially evident in most of the countries’ exports. Source: Forest 2 Market

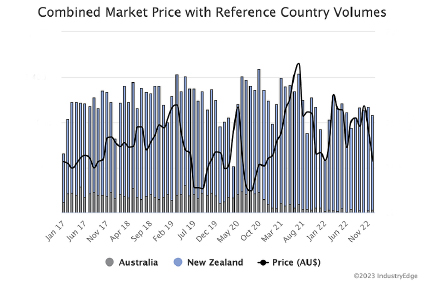

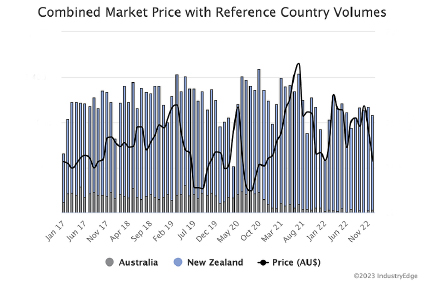

The Australian and New Zealand Export Log Price Index dropped in January 2022 to its lowest point in more than a year before rebounding sharply. Throughout the rest of the year it gradually declined, and by December the price index had fallen to a level lower than the January 2022 number.The combined index value for December trade shows that the average log price was 9.3% lower than the index starting point in January 2017.

The index combines and weights softwood log exports from Australia and New Zealand. It provides a consistent view of the price being achieved for the region’s logs and for the combined trade from Australia and New Zealand. It also reflects each of Australia and New Zealand exports separately.

December 2022 was the 28th consecutive month to record declines in Australia’s annual softwood log exports. The annual volume dropped significantly compared to the year prior.

Softwood logs are now being chipped and exported after China imposed a ban on Australian logs. Across the year ending December 2022, Australia’s total exports of softwood logs were down a significant 66.1% for the year.

India has emerged as a new market, receiving small but regular shipments. Monthly volumes fluctuated rapidly. For export, softwood logs are differentiated as larger or smaller than 15cm diameter. The distinction between log sizes was previously more noteworthy, but analysis has become challenging as monthly export volumes are increasingly erratic.

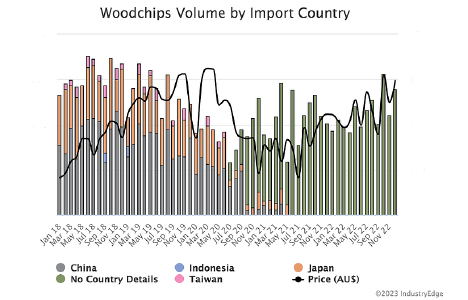

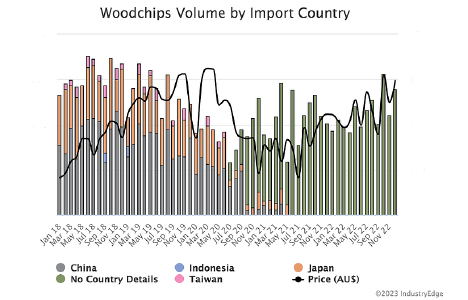

Annual Woodchip Exports Up 13.9%

Australia’s combined annual exports of hardwood and softwood woodchips for the year ending December 2022 were 13.9% higher than the prior year. Average monthly export volumes have trended upward since ‘confidentiality’ restrictions were introduced in the middle of 2020.

Australia’s entire woodchip export trade, including both hardwood and softwood, is still masked by confidentiality restrictions. This is otherwise known as ‘No Country Details’ (NCD). Accordingly, no formal export data is available – only the monthly total volume and a total average price reported by the Australian Bureau of Statistics (ABS).

Hardwood chips make up the bulk of Australian woodchip exports. Their annual volume increased 12.1% across the year.

Softwood chips continued strong growth. Softwood chip exports were up 22.1% compared to the prior 12 months. The large rise in softwood chip exports is driven by the inability to export logs to China.

Chipping has proven to be a continually reliable option for utilizing that resource. China is also facing a shortage of recovered fibre which has also driven demand for woodchips. These two factors have allowed Australian softwood woodchip exports to climb.